Google Cookie Delay – Third Time Lucky?

ICYMI – Google announced at the end of April that they are delaying the deprecation of third-party cookies on the Chrome browser for a third time since the original deadline of January 2020. This is due to heightened regulatory scrutiny – particularly from the UK’s antitrust enforcer, the Competition and Markets Authority (CMA).

The CMA is concerned with how Google’s plans could unfairly hinder competition, particularly how it’s Privacy Sandbox, designed to replace cookies for advertisers and publishers, may unduly preference Google’s own advertising products.

The IAB (Interactive Advertising Bureau) also raised similar concerns in February around challenges with advertising effectiveness, media measurement, brand safety, governance and transparency.

Google has not confirmed a new timeline but we know it will move into 2025.

Media of the Month: Ad Pause

The Media Shoppers have long been fans of Channel 4’s Ad Pause format which allows advertisers who don’t have video assets to still get exposure to C4’s video-on-demand viewers. Ad Pause is a high impact creative format that is displayed when viewers pause the VOD content, and the static ad remains on screen until the user resumes or exits the content.

We were therefore pleased to hear from ITV that the format is now also available on their ITVX BVOD channel, thus allowing advertisers to reach a much wider audience using the same assets. Whilst the format is available on both Connected TV (Big Screen) and desktop (clickable) with C4, for now ITVX are only offering it on non-clickable CTV, with desktop to follow later.

Audience and geo-targeting options are available with both broadcasters. Ask your Campaign Manager for more info.

Coffee Break: Navigating the Ethical and Sustainable Path to Working with AI

Take 5 minutes to read our latest blog from Head of Digital, Fiona Mills, who discusses how marketers must balance their desire to embrace AI in their marketing campaigns with ESG commitments.

TV still greatest driver of overall profit volume

New research from Thinkbox, the marketing body for TV in the UK, suggests that TV advertising is still the greatest driver of overall profit volume. The report, Profit Ability 2: The New Business Case for Advertising, is an update and expansion of Ebiquity and Gain Theory’s 2017 study. Based on £1.8bn media investment across 10 media, 141 brands, and 14 categories, the report gives the first post-Covid/Brexit view of advertising’s business performance.

A key finding is that TV accounts for 54.7% of advertising’s full payback but only accounts for 43.6% of total advertising investment. More generally, the study also indicates that 58% of advertising’s total profit generation happens after the first 13 weeks. For those looking for more immediate results, Generic PPC search accounts for the largest proportion of immediate payback (30.5%), with Linear TV the second biggest driver, accounting for 20.5%. This is followed by Paid Social (15.1%), Audio (8.6%) and BVOD (7.3%). Read more.

Podcast ads continue to grow

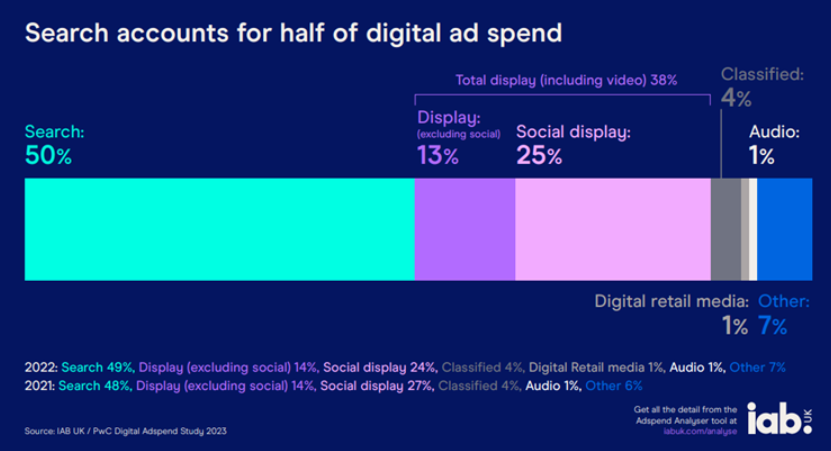

The IAB’s 2023 Digital Adspend report, released last month, shows that spend on podcast ads grew fastest y-on-y, by 23% to £83m, while connected TV (CTV) was up 21% to £1.17bn. Social video continued to perform strongly with annual growth of 20%. Growth rates in all three categories outperformed the digital ad market as a whole – underscoring the increasing appeal of these channels, possibly because they may be more immune to upcoming cookie changes than other forms of digital advertising.

Overall, the UK digital ad market experienced solid growth of 11% to £29.6bn last year. Search continues to underpin the industry, accounting for 50% of the market at £14.7bn, and with annual growth of 12%. Display also grew 12% to £11.3bn fuelled by video, which accounted for over 60% of total display spend for the first time.

Latest RAJAR data shows commercial radio is thriving

The highlights from RAJAR’s January – March 2024 radio listening data hit our desks last week. Highlights to take note of are:

Global’s Heart Breakfast with Jamie Theakston and Amanda Holden retained the top spot for a commercial breakfast show with 4.2m weekly listeners, up 4.3% on the previous quarter when it overtook BBC Radio 1.

Ken Bruce’s mid-morning show on Bauer’s Greatest Hits Radio has reached 4.1m weekly listeners, up 7% compared to the previous quarter, and 46% compared to the same time last year. Bruce joined from Radio 2 last May but, in his old slot, Vernon Kay is still comfortably ahead at 6.7m listeners.

Commercial radio reached a record audience in the last quarter with 39.7m weekly listeners, and a 54.2% share of listening compared to the BBC’s 43.4%. (Commercial overtook the BBC’s share of listening for the first time in Q2 2022.)

The proportion of listening to commercial radio via smart speakers has increased to 21%. This overtook commercial analogue listening for the first time, which registered 19% share in the quarter.

Listening via DAB made up 435m hours of listening in an average week, followed by 170m on smart speakers, 114 on website/apps, and 27m on DTV.